Are you looking for a new whip and do you want to know how to finance a used car? Look no further, you just found the right place!

There are times when people know they need a new car, but they are unaware of how to get the right financing. Should I finance a used car or should I buy a new one?

Understanding how much does it cost to finance a used car can help you make the right decisions any smart buyer would make. Keep reading as we will walk you through getting your new macchina and discover what is the best way to finance a used car.

As we begin to learn how to get a used car loan, remember that price is what you pay, but value is what you get. Are you ready?

Is financing a used car a good idea? Differences between financing a used car and purchasing a new one

A used car’s greatest advantage is its price. Let’s be honest. You can get a really good vehicle for a fraction of the cost of a new one. However, the interest rates and financing conditions of used cars are not always the same as when purchasing a new whip.

How come? The manufacturer usually provides incentives, discounts, or other tools to dealers so that they can sell brand new cars. In contrast, margins on used cars are lower, so dealers have fewer options for bringing prices down.

Also, dealers take advantage of car buyers who don’t have enough money to buy a new one and who often have poor credit scores. In addition, dealers have access to manufacturer financing options for new cars, but only third-party loan companies for used cars.

Long story in short, you should expect to pay more to finance a used car than a new one, but since the original buyer has already taken the hit of depreciation, you can enjoy a better car that’s just a few years old.

Consequently, do not focus only on the car’s price, but also on the loan terms and all related fees.

Buy a car in few steps and learn how to finance a used car today

Now, do you want to know how to finance your car like a pro and find the best deals? Let’s explore the process step by step.

1. Realize how much money you can afford to pay

It could be an obvious topic, but sometimes people don’t realize their budget and start dreaming about a fancy car they can not afford. So, don’t live obliviously and follow your finances. How much can you pay every month? How much downpayment can you handle?

Knowing how much you can afford will show you the type, size and price range of the car you will look for. Consider that different vehicles have different prices and a variety of costs and fees such as registration, insurance, and gas, among other ownership-related items.

2. Check your credit report

Your credit score will determine the interest rate you will be offered. Check it a few months before you plan to buy your car. Why? In case you have a poor credit situation, you can find ways to build your credit score.

Knowing your credit score will guide you on what loan terms and interest rates you can expect.

3. Boost your credit score

After checking your credit score, it is time to improve it. Take into consideration all the suggestions and ways to boost your credit score ahead of the moment you cross the dealer’s doors.

4. Decide the car you want to buy

Once you know your budget and your credit score, so you have a notion of your loan terms, it is time to decide what vehicle you want to buy. The more information you have related to your finances, the more options you will have in terms of cars.

5. Get pre-approved for a car loan

If you have the option to get a car loan pre-approval, go for it! It will give you the exact amount of money you can spend on your new used car, and you will have more room to negotiate with the car dealers. If you don’t have that option, no worries, we will tell you how to get the best financing for a used car later.

6. Compare different dealers for the right price

At this moment, it is essential to compare similar vehicles, trims, versions, and years of the car you want. Also, from different dealers and stores.

Why? Because the more you compare, the better decision you will take. Savvy car buyers believe that we should see at least 20 cars before deciding on the right one. Of course, the game changes if you find a rare gem or a well enough offer. That being said, at least compare your potential car to two more.

7. Review the vehicle history and get an inspection

In a remote and work-from-home world, we all love to do things on our computers. Well, buying a new car is not the exception. In that case, all professional dealers offer all the vehicle-related information and VINs, which you can check in the government agency to see the car’s history.

After checking that the vehicle has no bad history, it is good to go to the dealer and inspect the car. It is always good to check the car, drive it, go inside and walk around it. It will help you to understand the condition of the vehicle.

8. Shop with confidence

Once you have decided what car you want and have set the price with the dealer, sign all the paperwork and leave the dealership in your new, used car!

How to get the best financing for used cars

The most important part of getting the best financing for a used car is the preparations. As follow, bring a down payment, know what your budget is and understand your credit score.

Once you have all your homework done, compare your options in terms of car loans and different types of loaners.

Where to look for used car financing

Banks:

Traditional banks are the most popular place to look for a car loan. Usually, they offer special conditions to people who have accounts with them. Also, they have several options and types of credits.

Banks’ pros for auto loans:

- Easy credit requirements

- Special conditions and terms for clients

Banks’ cons for car loans

- Small room for negotiations

- Hight dependents on credit scores

Credit Unions

Credit unions are organizations that are on the side of main street and average people. They offer lower spreads and margins for loans, so you can get better interest rates that will cut your loan costs.

Credit Unions’ Pros

- Flexible credit requirements

- Discounts for members

Credit Unions’ cons

- Local based, not national customers

- Reduced commercial presence, so you don’t even know they exist

Online lenders

The internet has brought many advantages, including online businesses and lenders. In the last years, small online lenders have become popular among people who don’t have excellent credit.

Pros:

- Fast approvals

- Online accounts

Cons:

- High rates

- No customer services

Manufacturers

Carmakers have control of the business, so they can offer deals and offers directly to buyers.

Pros

- Direct credit with low rates

- APR deals on certified pre-owned vehicles

Cons

- Certified pre-owned cars may be more expensive

- Problematic for customers with poor credit

Dealerships

When you want to understand how to finance a used car, dealers are the street-by-street stores. You can get a variety of conditions there, including loans from third-party companies, banks, manufacturers, and even they can even loan the money to you directly.

Pros

- Dealers compare loans and offer you the best conditions available for you

- They can cut prices in order to get the car sold

Cons

- Interest rates may be high

- Car selection is reduced, and quality could be a pandora’s box.

How much does it cost to finance a used car?

Used car financing accounted for 44.81 percent of the overall automotive financing market in the second quarter of 2021, up from 38.05 percent in the same period of 2020.

Although used car loans are gaining popularity on the loan market today, buyers are unaware of the differences in interest rates and annual percentage rates between new and used cars.

In Q2 2021, the average new car loan amount was $35,163, with an average monthly payment of $575, according to credit rating company Experian. In the case of used car loans, the average loan amount was $23,365 with an average monthly payment of $430.

While new cars’ averages are higher than those for used vehicles, the final amount of money paid in interest is not relatively too different. The reason is the differentials in interest rates and loan rates.

While the average loan rate for used cars was 8.66 percent in the second quarter of 2021, the average loan rate for new vehicles was just 4.09 percent in the same period. In other words, buyers of used cars paid double in interest than those who finance new vehicles.

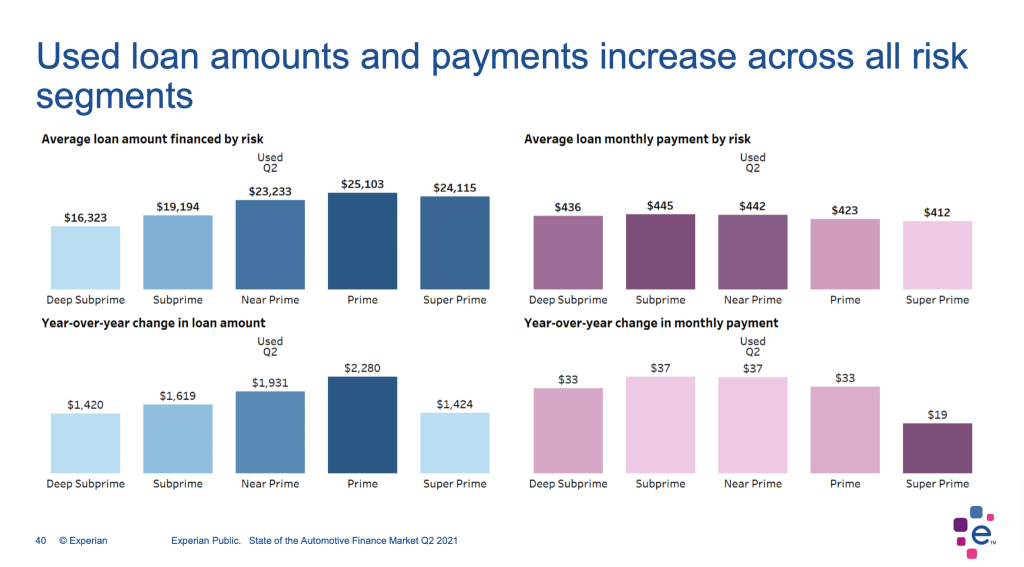

In that framework, Experian noted in his research State of the Automotive Finance Market Q2 2021, “loan amounts and payments remain at near-record highs and hit record-highs for used.”

How to finance a used car with bad credit?

The first thing you should understand is that financing any good with bad credit is expensive. You will not get the same interest rate if you have a prime score as if you have a sub-prime rate.

According to Experian, more than half of all used loans are for super-prime and prime scores. At the same time, just 3.37 percent of auto loans go for high risky deep subprime borrowers.

Credit scores ratings:

- Super prime: 781-850

- Prime: 661-780

- Near Prime: 601-660

- Sub Prime: 501-600

- Deep Sub Prime: 300-500

The average loan amount finance for near-prime borrowers was $23,233, just one thousand dollars less than the amount for super prime; however, monthly payments were 30 dollars more for the near prime segment.

In the case of deep sub primers, while the average loan amount financed was just $16,323, they paid $436 every month.

So, what should you do to avoid that extra costs? Follow these simple but significant steps:

- Check your credit (yes, again!)

- Determine what price segment you can afford

- Save for a down payment

- Visit different lenders and research for your opportunity

Learn more about how to boost your credit score.

What is the car of your dreams, and how to finance it as a used car?

I remember dreaming about the car of my dreams and the steps I should take to make it a reality. Eventually, however, I realized that my target vehicle is the one that gets me from one place to another.

A brand new car is nice, isn’t it? Of course it is. But it is also essential to understand your finance and take steps to get the best car you want while saving the most money you can. That is what smart buyers do.

So, when it comes to how to finance a used car, it becomes crucial to understand that with proper research, you can get cars that you hadn’t thought you could afford.

Now, do you want to know how to finance a used car, or will you just dream about it?